OUR SPEAKERS

Aksinya Sorokina Kavanosyan

Director at Alvarez & Marsal Financial Services

Aksinya Sorokina Kavanosyan is a Director with Alvarez & Marsal Financial Services in Dubai, UAE. She has extensive experience in end-to-end transactions and strategy advisory with primary concentration in trade and supply chain finance, and broader Corporate and SME Banking strategy. Aksinya spent a decade with IFC – World Bank Group, across Middle East, Africa, Asia, and Europe. She implemented transformational initiatives for 40+ financial institutions across 30+ countries across Europe, Middle East, Africa and Asia. At the latest tenure with IFC, she was a regional Middle East and Africa Lead of Supply Chain Finance Advisory practice. Prior, she executed corporate banking funding transactions at ING Bank. Aksinya is a CFA® Chartholder and an NYU graduate, having attended it on a Fulbright scholarship.

Leven Li

VP of Compliance, MEA at Crypto.com

Her extensive compliance career includes roles at Amazon Payment and the leading global BaaS platform, Embedded Finance, as well as Crypto.com UK. In the past two years, she has also been leading in developing AI compliance agents. Leven possesses deep experience in regulatory licensing, establishing and implementing financial crime and regulatory control frameworks, and building the necessary infrastructure to ensure the success of Fintech companies. She is passionate about creating agile RegTech compliance solutions that provide frictionless customer experiences while fully meeting regulatory requirements and reducing risk exposure.

Or Liban

VP of Middle East and EU Enterprise at Airwallex

Liban leads Airwallex's regional expansion and operations, driving growth in key markets. With over 15 years of experience in Sales, Business Development, and Partnerships, he has a strong track record of scaling global businesses. Previously, he headed Google’s Global Partnerships team across the Middle East, Sub-Saharan Africa, Turkey, the EU and Russia. His expertise in hyper-growth businesses and deep knowledge of Middle Eastern markets and the EU make him indispensable to Airwallex and its clients.

Ramy Fahmy

Regional Treasury Lead - MENA at Jacobs Solutions Inc.

A seasoned finance professional specializing in strategic treasury operations, with a strong commitment to developing future finance leaders through training programs and leadership initiatives.

Regularly engages in discussions on leadership, financial agility, and sustainability with a conversational and approachable style. Outside professional activities, enjoys spending quality time with family and participating in community-driven educational initiatives.

Najma Salman

Managing Director - Co-Head Institutional Cash & Trade CEEMEA Region at Deutsche Bank

Najma Salman is the Co-Head of Institutional Cash and Trade for Central & Eastern Europe, Middle East and Africa region at Deutsche Bank, based in Dubai. In her role, she is responsible for Cash and Trade sales for the region, which includes a team based in Frankfurt, Dubai, Cairo, Turkey and Lagos. She is a seasoned professional, with over 21 years of expertise in the banking industry. Commencing her journey in Corporate Banking at the National Bank of Dubai in 2002, she moved to Deutsche Bank in 2008, where she served as a Client KYC Officer and

subsequently led the KYC team. Having joined Sales in 2016, she transitioned to leading the team in 2022. Najma has completed her Bachelor’s degree in English Literature from Madurai University in India. She is also a Certified Anti Money Laundering specialist and an Associate of the Institute of Canadian Bankers.

Bahaadeen Merhi

Commercial Director & Regional Head of Partnership at Coface

Bahaadeen Merhi is the Head of Underwriting at Coface Credit Insurance. Coface is a multinational trade credit insurance company with direct and indirect presence in more than 100 countries and takes risks in more than 200 countries. Bahaa’s experience spans over 15 years, heading the Risk Underwriting, Credit Information and Policy Underwriting departments. In his roles, he has built Risk Underwriting Models to enhance risk mitigation, as well as Policy Underwriting Rules and Procedures, to strengthen ties with partners and policyholders. Prior to his role at Coface, Bahaa held several senior positions in reputable organizations such as Lebanese Credit Insurer, Obeji Chemicals Group (UAE), Rafco Trading Company, and Al Mawarid Bank. He holds a BS Degree in Business Banking and Finance from the Lebanese American University (2005) and is a certified Documentary Credit Specialist (CDCS).

Bharat Gupta

Sr VP & Head – Trade and Structured Finance at Olam Global Agri

Bharat Gupta is a veteran finance professional with more than 30 years of experience across Banking and Commodity Trading Companies. His expertise lies in structuring innovative trade finance strategies for supplier and customer finance that drive profitability, optimize working capital, build asset-light and debt-light solutions. Bharat has built and scaled businesses across Asia, Europe, Middle East, and Africa markets while working in India, Singapore and Dubai.

Bharat's career spans tenures with Olam Group, Louis Dreyfus Company, Cargill and large global MNC banks. He is currently based out of Dubai, UAE and manages his business as Sr VP and Head - Trade and Structured Finance, Asia and EMEA at Olam Agri.

Hamayoun Khan

Head of Trade & Working Capital at Commercial Bank of Dubai

Hamayoun Khan is an accomplished Electrical Engineer and MBA with over 23 years of extensive experience in both international and local financial institutions. He currently holds the position of Head of Transaction Banking at Commercial Bank of Dubai. His previous roles include significant tenures at ENBD Group (Emirates Islamic Bank) and Standard Chartered Bank, as well as major local banks in Pakistan. Hamayoun has demonstrated a successful track record in origination, client coverage, and product management. He has excelled in leading substantial business operations and possesses a profound knowledge of both conventional and Islamic banking trade and PCM propositions, including supply chain financing.

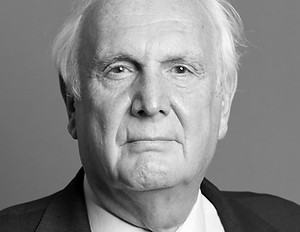

Lord Edward Udny-Lister

Co-Chair at UAE-UK Business Council

Lord Udny-Lister was ennobled by the Queen on the 6th November 2020 and took his seat in the House of Lords on the 19th May 2021. He was made a Privy Councillor on the 10th March 2021. Lord Udny-Lister served on the House of Lords International Agreements Committee from 2022 ton 2025 and now serves on the Industry and Regulators Committee. In the Middle East he is the Joint Chair of the UK UAE Business Council and a Director of the UK Saudi Business Council and a member of its Advisory Board. In Business Lord Lister is a Director of Gemcorp Capital Management Ltd and Chair of its UAE business. From July 2019 to January 2021, Lord Udny-Lister was the Prime Minister’s Senior Strategic Adviser based in 10 Downing Street. In that role he was responsible for Business, Trade, International Affairs and he had a specific responsibility for the Gulf. Prior to that, he was Chairman of Homes England 2016 to 2019. Homes England was responsible for the UK Governments land holdings for housing and the planning processes to make them investable. He was also responsible for the provision of the Help to Buy and Affordable Grants programmes. From 2016 he was also an adviser on inward investment at the Department of International Trade and a non-Executive Director at the Foreign and Commonwealth Office. From 2011 to 2016, he was Chief of Staff and Deputy Mayor of London responsible for Policy and Planning and was Leader of the London Borough of Wandsworth 1992 to 2011. He also served on the London Legacy Development Corporation from 2011 to 2016(the body responsible for the Olympic Park) and was the Chair of the Old Oak Common Development Corporation 2014 to 2016 which was the regeneration Authority for an extensive area of west London. In 2012 he had responsibility for all business engagement around the Olympic Games in London. From 2013 to 2016, he was Chairman of London & Partners – London’s investment agency. Lord Udny-Lister was knighted for Services to Local Government in 2011. His achievements in regeneration have been widely recognised and in 2011 was made a Freeman of the London Borough of Wandsworth. In 2014, he was awarded the London First Award and Estates Gazette London Award. He is also a Freeman of the City of London.

Aleem Siddiqui

Head of Finance - Gulf region at MBRF

Aleem Siddiqui is the Head of Finance for the Gulf region with nine years of experience at BRF. Specialising in the FMCG sector, Aleem oversees the treasury functions for the GCC, Latin America, and the Far East. Their current responsibilities also include managing FP&A for the Middle East and Finance Controlling for regional factories. With a solid background in FP&A, finance operations, and revenue management, Aleem is dedicated to optimising financial performance and driving operational excellence across diverse markets.

Michal Ron

Chief International Business Officer at SACE Italy

Michal is the Chief International Business Officer of SACE, holding responsibility for the Overseas Network, 15 offices across the globe.

From 2020 to 2022, Michal was the elected President of the Berne Union, the global association of export credit and investment insurers, where she also served as Vice President from 2014 to 2016.

From 2018 to 2021 Michal acted as Vice Chairman of the Board of Directors of the African Trade Insurance Agency (ATIDI), where she also held a director position until July 2023. From 2017 to 2020, she served as the first Secretary General of the International Working Group (IWG), a multilateral initiative between OECD and non-OECD countries aimed at setting common rules for official export credit support.

Yan Bechet

Chief Operating Officer, UAE at HSBC Bank Middle East Limited

Yan Bechet is the Chief Operating Officer for HSBC in the UAE, leading operations across one of the bank’s most strategically important markets in the region. He brings over 20 years of international banking experience, having held senior roles in the UK, France, Germany, Egypt, and the UAE.

Prior to his current role, Yan served as COO of Corporate Banking UAE, where he led key functions including client due diligence, onboarding, and financial crime risk. He also led Corporate Banking across Dubai and Northern Emirates.

He is actively engaged in driving operational excellence, regulatory engagement and transformation, and digital enablement across the bank.

Graham Scopes

UAE and Kuwait Country Head at UK Export Finance

Graham Scopes joined UKEF in January 2022. Graham brings with him over 35 years of commercial and investment banking experience, gained in London and the Middle East, living in the Gulf since 1997. He has a strong track record of originating, structuring, executing and syndicating diverse transactions, as well as establishing successful and trusted client relationships.

He worked for JP Morgan Chase for 19 years, completing his ‘credit training’ in New York. 12 years in London as a multi-products banker to energy clients in Europe, Africa and the Middle East; followed by four years in Bahrain, originating Corporate Finance transactions for clients across the GCC.

Graham spent a further 16 years with Bank ABC (formerly Arab Banking Corporation), headquartered in Bahrain, leading its Corporate, Project and Structured Finance business and Wholesale Banking (five departments). His team developed a >$6bn risk assets portfolio in the Middle East and North Africa, across all significant regional industries, while establishing a successful project finance advisory franchise.

Graham was appointed to Board positions for eight years, including Vice Chairman of ABC Islamic Bank, and then Chairman of ABC Tunisie. He represented the Wholesale Banking division on all major Head Office management committees, including Credit, Risk and Compliance – and co-led a bank-wide transformation programme with McKinsey.

Graham Scopes brings to UKEF a diverse and strong track record of delivering financing solutions across multiple geographies and industries. Since joining UKEF in Dubai, Graham has originated a significant pipeline of transaction opportunities and established a reputation for clearly presenting export financing support solutions to potential buyers and UK suppliers.

Sagar Kasare

Head - Trade Finance at Axis Bank, Dubai

Trade Finance leader with 15+ year’s experience driving client acquisition, revenue growth, and product innovation. Proven track record in building relationships with top Indian conglomerates and leading DIFC branch growth, while managing a diverse portfolio across structure trade finance, risk participation, and digital trade finance solutions.

Ashish Kumar Singh

CEO at Loyyal

Ashish Kumar Singh has been a Web3 pioneer in MENA since 2013, contributing to major blockchain success stories since 2017.

As CEO of Loyyal, he is transforming loyalty and payments with patented blockchain and AI infrastructure. He has led national and enterprise Web3 initiatives for Smart Dubai Government, Saudi Aramco, Dubai Police, Etisalat, and BENEFIT Bahrain.

A recognized thought leader, Ashish has contributed at leading forums including the World Economic Forum (WEF). He has been instrumental in educating the region on the value of open and interoperable Web3 ecosystems. Under his leadership, Loyyal is gaining global traction with its AI-powered, tokenized loyalty infrastructure.

Ashish continues to advance the Loyyal Suite, empowering SMEs and enterprises to launch zero-cost loyalty programs. His vision solidifies his standing as one of MENA’s most influential voices in blockchain innovation.

.jpg)

Ashish Gokhale

Executive ‑ Business Development Strategic Marketing and Communications at National Bank of Fujairah PJSC

Ashish is responsible for driving NBF’s ESG strategy, policy and reporting. He has also developed the Sustainable Finance portfolio proposition for the bank.

A seasoned banker with an experience spanning 2 decades in the industry across India and the UAE, he has earlier worked in Standard Chartered and Citi across transaction banking, supply chain financing and credit structuring.

Ashish is a Mechanical Engineer and a postgraduate in Management from the Indian Institute of Management Bangalore. He is also a Certified Green and Sustainable Finance Professional (Chartered Banker) and holds the Certificate in ESG Investing, CFA.

Rasheed Hinnawi

Chairman at ITFA MERC Solutions Inc.

Rasheed relocated with HSBC from London to Dubai in 2019 to set up a Portfolio Management & Distribution hub in MENA and Turkey (MENAT) for the region’s Global Trade & Receivables Finance business. His primary responsibilities include effective management of the MENAT Trade Finance book and enabling healthy growth through primary & secondary distribution to a diverse investor base.

He has over 15 years of international banking experience with an extensive MENA focus. Prior to HSBC, Rasheed was the Head of Financial Institutions, Trade and MENA Corporates at Europe Arab Bank. He holds an MSc in International Banking & Finance and is a Certified Trade Finance Specialist.

Hans Moerman

CFO at DP World Digital

Hans Moerman is the CFO at DP World Digital, a global leader in logistics and smart trade solutions. In this role, Hans is responsible for driving the strategy for digital freight and trade solutions, delivering DP World's internal digital transformation and commercialisation of DP World’s systems. Prior to joining DP World, he led the enterprise sales strategy for Asia Pacific at Amazon Web Services and held the CFO position at Lazada Logistics. With a background in private equity, Hans brings a strategic financial perspective to his role. Hans holds a bachelor's in Physics from Leiden University and a master's in Quantitative Finance from Erasmus University Rotterdam.

Marcelo Moulin

Head of Trade and Working Capital Sales, Middle East and Africa at Citi

Marcelo is a highly accomplished sales leader with over 18 years of expertise in the banking sector. He currently spearheads the Trade Sales team across the Middle East and Pakistan.

Beginning his career as a trainee at Citi in 2007, Marcelo has cultivated a diverse background across various sales roles, regions, and business lines. His journey included a tenure in the Corporate Solutions Group Sales within Markets, followed by a move to Treasury and Trade Solutions (TTS), where he provided comprehensive Cash, Trade, and Cards solutions to corporate clients before taking on his current leadership role in trade sales.

Known for driving significant growth and transformation, Marcelo consistently demonstrates a client-oriented focus throughout his extensive Markets and TTS experience. His global perspective is honed by spending approximately half of his career overseas, with pivotal assignments in Brazil, Russia, the UK, and the UAE.

Marcelo holds a bachelor’s degree in Computer Engineering, a Post-Graduation in Business Economics, and an Executive Leadership certification from the University of Oxford.

Vinit Mishra

Head of Treasury – Nutrisco (ETG Group) | FCMA, CGMA, CIMA (UK), CTP at ETG Group

Vinit Mishra serves as Head of Treasury at Nutrisco (ETG Group), where he focuses on building resilient and efficient financial frameworks across liquidity management, trade finance, and sustainable finance. With professional certifications including FCMA, CGMA, CTP, and CIMA (UK), he brings a thoughtful and collaborative approach to treasury leadership.

Over the years, Vinit has contributed to several award-winning initiatives, including recognition at the ADAM SMITH Asia Awards for treasury and funding solutions, and The Asset Triple A Award for ESG-focused trade finance. These acknowledgements reflect his commitment to practical, purpose-driven financial strategies.

Vinit is passionate about fostering dialogue within the treasury community and sharing insights that help organisations navigate complexity and change with confidence.

Bagya Nambron

Senior Counsel at Bracewell LLP

Bagya Nambron is a Senior Counsel at Bracewell in Dubai with over 20 years of international

banking and finance experience. She is qualified in England & Wales, Ireland, and India. Bagya advises on complex projects and export financings, working with export credit agencies

worldwide—including Korean ECAs—as well as multilaterals.

Her experience spans renewables, power, infrastructure, petrochemicals, oil and gas, transportation, natural resources, pulp and paper, and telecommunications. Having worked both in-house and in private practice, she brings a practical and commercial perspective to cross-border transactions.

She has significant experience across emerging markets in the Middle East, Africa, Asia, and the

Americas, and continues to support international clients on high-profile, strategic financings.

Ahmed Salahy

Head of Strategic Partnerships at Careem Pay

Ahmed Salahy is the Head of Strategic Partnerships at Careem Pay, the FinTech division of Careem, where he has played a key role since joining in 2021. In this role, Ahmed leads the development of strategic partnerships across product, tech, and commercial partnerships with FinTechs, PSPs, partner banks, regulatory bodies and global payment schemes. His primary focus is on building seamless, digitally integrated customer experiences and sustainable value props for Careem Pay’s suite of financial services and payment products. By delivering simplified digital payment acceptance and streamlined disbursement solutions, Ahmed aims to drive growth and expand Careem Pay’s footprint across the MENAP region.

Before joining Careem, Ahmed led payment partnerships at Network International (NI), the leading payment processor in the Middle East and Africa, where he managed a comprehensive portfolio of payment processing and merchant solutions, supporting both issuers and acquirers across the MEA region. Previously, he held strategic roles at Amazon Payment Services (formerly PayFort) in the UAE, where he was responsible for driving growth through strategy, product development, and business expansion across the UAE, Egypt, Jordan, and Lebanon.

Ahmed began his career at HSBC Bank in Egypt as a Senior Investment Associate, where he developed expertise in product development, investment analysis, and portfolio management.

Ahmed holds a Master’s degree in International Finance and Management from Royal Holloway, University of London, a Postgraduate Diploma in Investment Management from the American University in Cairo (AUC), and a Bachelor’s degree in Financial Management from the Arab Academy for Science and Technology (AAST).

Ahmad Dabbousi

Regional Vice President - Head of Trade Credit at ACE Gallagher

Ahmad Dabbousi is the Regional Vice President - Head of Trade Credit at ACE Gallagher, where he leads the firm’s trade credit operations across the GCC. With over 17 years of experience in insurance and financial services, he has a proven track record in building and scaling business lines, structuring complex reinsurance programs, and driving sustainable growth. His leadership is marked by a strategic focus on market expansion, developing distribution networks, and designing innovative credit solutions for corporates and financial institutions. Ahmad is widely recognised as a leading voice in trade credit insurance across the Middle East and emerging markets.

Maninder Bhandari

CEO of Delpasin DMCC

Maninder Bhandari has 40+ years of multinational experience gathered from his work in Latin America/Caribbean (Sao Paulo, Brazil), North America (Miami), Far East (Hong Kong & Singapore) & Middle East/Africa (Dubai) with regional leadership roles, board positions and as CEO of multiple businesses.

Via his years at HSBC, ABN AMRO and The Bank of New York Mellon in regional and global positions - he had specific responsibility for the respective regions, Mr Bhandari has seen multiple downturns and crisis (Thailand, Indonesia, Argentina, USA) yet steered the businesses to strategic growth. At the Bank of New York Mellon, Mr Bhandari had regional responsibility of over 30 countries in Middle East & Africa.

His quest for inorganic growth and leadership led him to be a founding partner of a Private Equity fund, investing in mid-cap companies in the IT/Education/Health care sectors. He was a board member of the investee companies prior to his sale of his interests in the fund. Whilst growing the fund via raising growth capital and investing in cross border deals, Mr Bhandari was also partner/director in a group providing non core back office services, which group now has 13 companies and 5000 staff. Mr Bhandari sold his interests to a USA Nasdaq listed multinational.

Concurrent to the above, Mr Bhandari was an advisor to an UAE financial institution and spearheaded a team to set up a new onshore bank in the UAE to promote trade with Africa & East Europe – the new frontiers of growth.

Subsequently, as CEO of a 4-company group, Mr Bhandari nursed the group to financial stability despite trying circumstances, which required a strategic turnaround.

He currently is an independent advisor to Ernst & Young as well a Director on multiple entities involving FinTech, Back Office Services, and International Operations.

Mr Bhandari enjoys public speaking and has written articles (published in finance magazines and in daily newspapers) on a wide range of commercial subjects. He remains on the editorial board of a global trade publication based out of London (UK) and continues to be a Speaker/Chair of trade conferences.

Mohamed Kortam

Regional Treasurer – Middle East & Afric at Lesaffre

Kortam is the Regional Treasurer for Middle East and Africa (MEA) region, one of Lesaffre’s largest, encompassing over 70 countries, 14 entities, 8 production sites, 7 Baking Centers and 7 Baking Ingredient Units, in key countries like UAE, Egypt, Turkey, South Africa, Morocco, Tunisia, Algeria, Ivory Coast, Zimbabwe, and Kenya

Kortam has led several financing solutions for Africa businesses including Syndicated loans, ECA facilities, discounting facilities, supply chain financing facilities and bilateral facilities. In addition to formulating strategies and building business custom models to manage Liquidity, FX exposure and finance charges associated risks.

Kortam is a Certified Treasury Professional (CTP) and a Chartered Financial Analyst (CFA), with over a decade of diversified finance experience in the areas of corporate finance, working capital management and financial risk management across various industries including Heavy machinery, FMCG and Pharma focusing on the region of Africa and the Middle East.

Ayman Al Rayess

Commercial Director at Allianz Trade

Ayman Rayess is the Commercial Director of Allianz Trade Middle East, leading all commercial activities, including sales, account management, underwriting, and marketing. With 15 years of experience in trade credit insurance, he focused on building high-performing teams and developing strategic commercial approaches to drive top-line growth.

He has played a key role in restructuring the Saudi business to market leadership and achieving record-breaking growth for the company in the region. His next focus is on expanding the growth of Trade credit insurance through financial institutions.

Sachin Rustagi

Head Trade Finance of Wio Bank PJSC

Sachin is a seasoned banking professional and leads the Trade Finance team at WIO Bank. With extensive experience across international banks, he specialises in fundraising, structured trade finance, debt management, and syndications, with a strong focus on the UAE and African markets.

Varun Divecha

Head of Commercial – Middle East at Atradius

Varun Divecha serves as the Head of Commercial – Middle East at Atradius. He is based in Dubai and is responsible for steering regional growth and strengthening Atradius’s market presence in the Middle East.

With nearly two decades of experience in financial services, his career reflects a steady progression through roles requiring strategic insight and operational excellence.

He began in banking, spending seven years building a strong foundation in financial analysis and operations. He later transitioned into the credit insurance industry, where he has spent the past 12 years. His journey spans roles from Account Manager to leading regional commercial teams, shaping market strategies, driving revenue growth, and supporting businesses in mitigating credit risk across local and international markets.

Throughout his career, Varun has focused on building strong commercial strategies, fostering client relationships, and leading teams that deliver measurable impact. He is passionate about helping businesses navigate new markets and expand with confidence by leveraging trade credit insurance to mitigate risk while enabling growth.

Ghansham Das

Head Group TBML Quality Assurance at Habib Bank AG Zurich

With 21 years of banking experience, Ghansham brings deep expertise in Trade Finance, Trade Compliance, Financial Crimes, and Risk Management. Holding an MBA and Junior Associateship certification from the IBP Pakistan, he began his career in 2005 as a Management Trainee Officer at Habib Bank AG Zurich and has since maintained a 20-year-long standing association with the HBZ Group.

Throughout his tenure, he has led various key units within Habib Metro Bank Pakistan, including serving as Head Doc Collection Unit and Head FE Helpdesk, a dedicated team established to educate branches on FE regulations compliance. In 2020, he transitioned to the Compliance function of HMB Pakistan as Head TBML Monitoring Unit, which he built from the ground up, where robust controls were developed and implemented to mitigate TBML risks across the bank.

In January this year, he started at the HBZ Group Office in the UAE as Head Group TBML Quality Assurance, a specialised unit tasked with assessing the quality of TBML processes, identifying critical issues, and providing strategic recommendations to strengthen the compliance and risk management framework across all subsidiaries of Habib Bank AG Zurich.

Murad Fuad Awwad Fakhouri

Claims & Recoveries Manager at Etihad Credit Insurance (ECI)

Murad Fakhouri is an experienced leader adept at credit risk management and claims operations, currently overseeing claims at Etihad Credit Insurance - the UAE’s federal export credit agency. With over 14 years of experience in the financial and insurance sectors, Murad has extensive expertise in strategic thinking, operational excellence, and client-centric innovation.

Throughout his meritorious career, he has played a pivotal role in transforming claims operations, enhancing client servicing standards, and integrating legal, underwriting, and recovery strategies into streamlined claims frameworks. Murad is also experienced in cross-border trade risk, debt recovery, as well as legal enforcement processes, and he frequently collaborates with international partners and financial institutions.

A passionate advocate for knowledge sharing and industry development, Murad has contributed to various policy development and internal training programs. His practical expertise and strategic foresight make him a valued voice within the realm of credit insurance and sovereign export support.

Vincent O’Brien

Director at ICC UAE

Vincent has been actively involved in trade finance for more than a quarter of a century and has delivered technical assistance for trade finance in more than 100 countries. Vincent’s primary activity is trade facilitation with the major Multilateral Development Banks, and his recognised speciality is trade-related dispute resolution, where he often acts as Expert Witness in Trade Disputes and Legal Cases.

Vincent also holds the position of Associate Director of the Institute of International Banking Law and Practice (IIBLP).

Christelle El Metni

Senior Relationship Manager at Exante

Christelle El Metni is a seasoned sales and customer relations professional with a diverse background spanning banking, wealth management, and account management. She combines her expertise in business analysis, team leadership, and financial solutions with a passion for cultivating long-lasting client relationships. Fluent in English, Arabic, and French, Christelle thrives in multilingual and multicultural environments, driving growth and delivering exceptional client experiences.

With nearly a decade of experience at BankMed, Christelle demonstrated exceptional skills in customer service and sales coordination, addressing complex client needs, cross-selling financial products, and leading branch employees. Her leadership extended to representing the bank at exhibitions and events, solidifying her reputation as a trusted face of the organization. Christelle's early career included roles as a Personal Executive Banker at Al Mawarid Bank

Christelle holds an International MBA from USJ – Sorbonne Business School and Paris Dauphine PSL, complementing her bachelor's degree in Human Nutrition and Dietetics from the Holy Spirit University of Kaslik. She is a certified Professional Certified Marketer (PCM) and has completed numerous certifications in sales, project management, CRM systems, and banking ethics.

Christelle’s core competencies include CRM proficiency, portfolio management, financial trading, and contract negotiation.

As a proud member of 100 Women in Finance and CISI ,

Christelle leverages her dynamic skill set and client-focused approach to excel as a leader in business development and financial services.

Christelle currently hold the position of SENIOR RELATIONSHIP MANAGER at EXANTE.

Inna Le Guen

CEO at Management Advisory Limited

Inna is a seasoned global executive with 25 years of experience in Fortune 500 companies.

Based in Hong Kong, as CEO of Management Advisory Limited, Inna supports Boards and executives in governance, finance, international business collaboration, enterprise transformation, and market diversification across uncertain economic, political, and ever-changing technology environments. Her focus is on achieving business scale, operational excellence, cost optimization, and risk management in complex business landscapes. Previously, Inna held senior management roles across North America and Asia in one of the finest financial institutions, delivering proven board-level expertise and strategic approach to growth acceleration. Inna is a member of several distinguished organizations, including: British Chamber of Commerce, Canadian Chamber of Commerce, Hong Kong Institute of Directors, Advisory Board Centre, Woman’s Directorship Programme Alumni.

Malek Al Khatib

Credit Insurance Manager at National General Insurance Company (PJSC)

Malek Al-Khatib, born in the UAE in 1979, is a Jordanian expert in corporate finance and credit risk. Malek began his career in 2004 at Commercial Bank of Dubai- Head Office, managing credit facilities of corporate accounts and project finance.

He later served as Corporate and Institutional Banking Relationship Manager at Arab Bank plc in the UAE. In 2010 Malek led credit risk assessment at Allianz Trade – Middle East, the global financial services firm and since then he took the responsibilities of many credit underwriting missions in UAE, Qatar, Saudi Arabia and Oman. In 2024 He join National General Insurance Company PJSC, “NGI” as Credit Insurance Manager to lead the foundation of trade credit Insurance department through introducing Single Buyer Credit Insurance policies. Malek holds a master’s degree in finance & accounting from the University of Dubai, and He is a certified credit risk professional -CCRP® from IABFM.

Mohamed Shyam Anver

Associate Director, Technical Programs at China Systems Middle East

Shyam is the Associate Director at China Systems Middle East for the past 26+ years. His experience spans over 35 years in Banking software deployment, implementation, production support and system administration.

He is responsible of implementing CS flag ship products Eximbills Enterprise and Customer Enterprise (Trade, Payments and Supply Chain Finance) in the Middle East and Africa. He had worked with multiple banks in many countries showcasing his team work and management skills.

Mr. Anver got his Master’s degree from University of Wales, Cardiff, specialized in business administration and project management. He is also a professional and a chartered member of the British Computer Society, Professional Member of the Chartered Professional Managers of Sri Lanka.

Shyam was project lead on the innovative project that won the ICC Trade Transformation Challenge 2025.

5.jpg)

Viacheslav (Slava) Oganezov

Co-Founder & CEO of Finverity

He founded the company with the mission to help resolve the $2.5 trillion global trade finance funding gap and enable better accessibility of working capital for businesses globally through digitising and disrupting the trade finance industry

Previously, he was a strategy consultant with PwC, advising banks on digital strategies and innovation. He holds a Master's in Management of Information Systems and Digital Innovation from the London School of Economics. He credits his positive attitude, clarity of vision, and power of intention to his conscious lifestyle that includes meditation, frequent exercise and plant-based diet.

.jpg)

Abdul Gafoor Thange

Country Manager – UAE, ICIEC Representative Office

Abdul Gafoor Thange is the Country Manager at the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a member of the Islamic Development Bank Group. He manages client relationships across UAE and Oman, focusing on providing trade and investment credit insurance solutions, facilitating risk mitigation, and supporting regional clients in advancing their projects. With extensive experience in international finance and strategic partnerships, he plays a key role in ICIEC’s operations in the Middle East and North Africa region.

Waël Emadaldin

Head of Global Trade Solutions & Working Capital Management at BNP Paribas

Wael Emadaldin is a senior finance leader with 18 years of progressive experience at BNP Paribas, specialising in transaction banking across the Middle East and Africa. He currently leads Global Trade Solutions & Working Capital Management in the UAE, overseeing teams that provide integrated solutions for multinationals, strategic enterprises, and government‑related entities. Prior to his current position, Wael held roles as Director of Global Trade Solutions & Working Capital Management and Head of Products & Business Management for Corporate Banking MEA, managing trade, cash management, correspondent banking and specialised financing initiatives. He began his BNP Paribas career in 2006, gaining deep expertise in market risk and product control for Global Markets and ALM/Treasury. Earlier IT and security roles at Bahrain Bourse and GFH Group provided him a foundation in technology risk and operational resilience. Wael holds a degree in Management of Information Technology from the University of Sunderland.

Viktoria Soltesz

Founder at The Soltesz Institute

With over 20 years in banking, payments, and taxation, Viktoria Soltesz designs strategies built on how banks think, ensuring that money moves smoothly, safely, and at optimal cost. She runs an accounting, audit, and tax consulting firm in Cyprus and founded PSP Angels to provide practical answers to complex banking and payment questions. She developed the Soltesz Payment Framework, used by companies worldwide, and established the Soltesz Institute, the leading EU-accredited training provider for the payment and banking industry. Viktoria is a European Certified Trainer, has lectured at the University of West London, and is a regular speaker at international conferences advocating for an ethical and transparent payment and banking industry. She authored the best-selling Moving Money – How Banks Think and The CPayO (Chief Payment Officer), and was named Businesswoman of the Year 2023. PSP Angels and the Soltesz Institute have received multiple international awards for excellence.

Vikas Jha

Managing Director & Senior Executive Officer at Finneva

Financial Services (DIFC) Limited

Vikas is the SEO of Finneva Financial Services (DIFC) Limited, a DFSA regulated financial services firm based out of DIFC, UAE. He is on the board of a few fintechs in the region and has interests in how digitization of trade promotes financial inclusion.

He is an experienced financial services professional with over 2 decades of experience. He has held senior leadership roles at Emirates NBD, DBS Bank India, HSBC, and ICICI Bank, where he successfully developed and scaled financial solutions, particularly in Transaction Banking, Corporate and Institutional Banking. In his last role Vikas was Group Head of Trade and Supply Chain Financing for Emirates NBD, a leading bank in the region.

His extensive experience spans multiple regions, including South Asia, Europe, and the Middle East, with a strong focus on driving innovation and delivering impactful financial solutions